So here is what you have to do:

-

Researching Stocks: The first step in selecting your first stock is to research potential investments. This includes finding reliable information about the company, analyzing its financial statements, evaluating its valuation metrics, and considering its performance in its sector and industry. Additionally, it's important to consider the broader market conditions and any events that may affect the stock's performance.

-

Assessing Risk and Return: Once you have a good understanding of a potential investment, it's important to assess the risk and return associated with it. This includes considering the stock's volatility, its past performance, and the potential for future growth. It's important to balance the potential returns with the level of risk you are comfortable taking on. Additionally, It's important to consider the company's valuation metrics such as P/E, P/S, and P/B in relation to its industry averages and its peers.

-

Making an Informed Decision: After researching and assessing potential investments, it's important to make an informed decision. This includes considering your investment goals and risk tolerance, as well as the broader market

"Hold on. What the hell is this?" This is complex stream of technical terms and confusing instructions. You clearly missed the point that I am a beginner who has no prior understanding of the stock market. "Do you think I am some kind of finance wizard?"

If this is what you are thinking, then let me assure you, we are not going to do any of the above for our first purchase. All we are going to do is to leverage what you already know and top it up with a little bit of common sense. Having said that, we will meet them again in another article down the line.

Trust me, I don't want to scare you away from the stock market before you even get started!

Just in case you want to explore more about multibaggers, you can do it here.

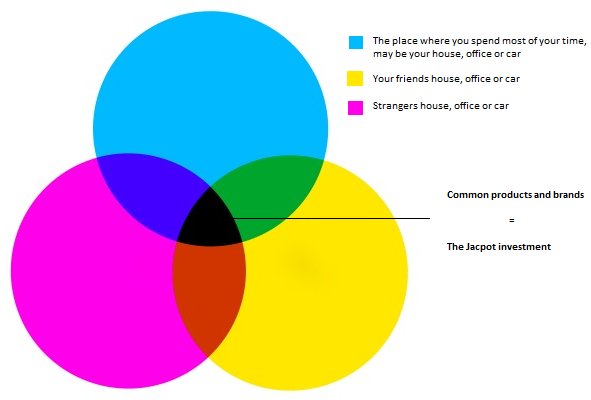

Being an observant investor who invests in the stock of a company whose product you see frequently can have few advantages compared to investing in a random stock you heard somewhere or from someone:

-

-

Market insight: You have a first-hand perspective on the product's popularity and potential for growth, giving you valuable market insight.

-

Brand recognition: Companies whose products you see frequently often have a strong brand and a loyal customer base, which can lead to consistent growth and stability.

-

Better judgement: You have a better judgement of the product's quality and potential for growth compared to a product you have never seen before.

-

Again there are few reasons why you may be better off investing in a stock of a company that offers a product you use regularly:

-

Familiarity: You have a better understanding of the company and its products, as you are a regular user.

-

Market insight: You have a first-hand perspective on the product's popularity and potential for growth, giving you valuable market insight.

-

Brand loyalty: Companies with products that you use regularly often have a strong brand and a loyal customer base, which can lead to consistent growth and stability.

-

Better judgement: You have a better judgement of the product's quality and potential for growth compared to a product you have never used before.

Investing in the stock of the company you work for can have several advantages compared to investing in your neighbors company:

-

Insider knowledge: You have inside knowledge about the company's performance, culture, and future prospects that the general public may not have access to.

-

Personal connection: Investing in the company you work for can give you a personal connection and a sense of pride in its success.

-

Alignment of interests: Your financial interests are aligned with those of the company, as both you and the company want to see its stock price increase.

I will take your leave now. But not before highlighting what you just achieved by buying your first stock.

Buying your first stock is a major accomplishment that opens up new opportunities for financial growth and personal development. By taking the step to invest in the stock market, you have:

-

Broken through the beginner's dilemma: Investing in the stock market can be intimidating for beginners, but by taking the first step and buying your first stock, you have overcome the fear of the unknown and started your journey towards financial literacy.

-

Opened up new opportunities for additional income: Investing in the stock market can provide a source of passive income, giving you the potential to grow your wealth over time.

-

Trusted yourself and developed new skills: By undergoing this first purchase exercise, you have developed self confidence, critical thinking and problem-solving skills.

-

Diversified your portfolio: Although it is not apparent, but by investing in your first stock, you have taken an important step in diversifying your financial portfolio (of FD's, Gold, Savings etc) and spreading out your risk.

-

Demonstrated a commitment to your financial future: By investing in the stock market, you have shown that you are committed to taking control of your financial future.

Congratulations on this major milestone and best of luck on your investment journey!