Data update on:

Let's begin our quest for multibaggers.

But this time backed by real life data and not big talks and confusing jargon.

Here is a one line definition of a multibagger directly from wikipedia:

A multibagger stock is an equity stock which gives a return of more than 100%.

However a more common sense definition from retail investors perspective should ideally be:

A multibagger stock is an equity stock which has always given a return of more than 100% in hindsight.

Retail investors can relate to this definition more than the previous one ;-).

Anyways, let me ask you two interesting question -

1. How a company becomes a multibagger and

2. Can we spot a multibagger when there is still time?

Hopefully, once you reach the end of this article while simultaneously interacting with the data tables and charts below, the odds of finding one early will surely move few notches up from where it is currently for you.

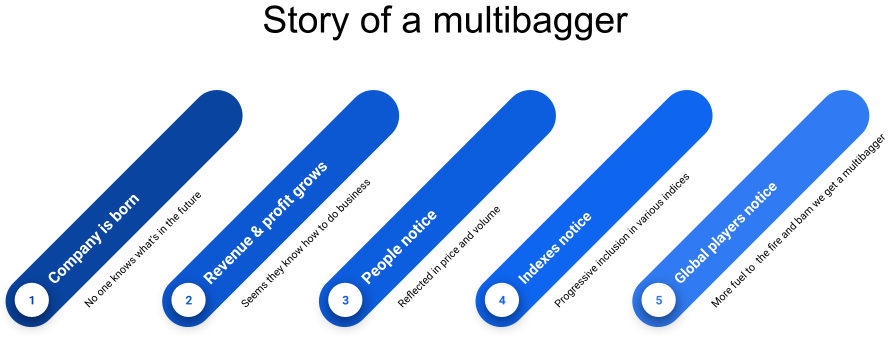

Now, to answer the first question, here is the life cycle of a multibagger stock:

Let's break down the journey step by step and see where we reach.

Step 1 - Figuring out the pockets where probability of finding a multibagger is maximum - Revenue, Profit and PE analysis

Try to answer this - out of small caps, mid caps and large caps, which companies have the highest probability for becoming a 10 or 100 bagger?

Generally speaking, small and medium cap stocks will have higher probability of turning into a multibagger in relatively shorter time span. Not hard to imaging the kind of time, effort, management quality and efficiency that would be needed to create a company 100 times bigger than Reliance, TCS, or HDFC bank.

It's any which way easier for a company to grow revenue from 1000 crore to 1 lakh crore than from 1 lakh crore to 100 lakh crores. So hopefully you are with me on this:

Small and medium cap stocks have higher chance of becoming a multibagger as compared to a large cap stock

Let me give you an interesting revenue range to start with.

Focus on companies which have revenues in the range of 100 to 5000 crores. You must have guessed by now that any company below 100 crore revenue figure will be too risky to handle and any company having revenue in excess of 5000 crore will be too difficult to scale. So, here is the list of companies falling in the revenue range of 100 to 5000 crores:

I don't want to force you to stick to this revenue range and just in case you need to explore companies falling in rest of the revenue ranges you can do it here.

Getting back to the data in above chart.

By any standards, the number of companies is overwhelming and hence we need to refine our filters further.

What about finding all the industries where the revenue difference between the top player and the remaining no 2, 3, 4 ... players is substantial leaving scope for 2nd rung players to turn to multibagger?

So if the top player has revenue share twice that of no 2 then roughly speaking no 2 might be a potential 2 bagger of the future. Similarly, if the top player has revenue share 10 times that of no 2 then roughly speaking no 2 might be a 10 bagger of the future.

If you are with me then here is a list of industries where lies a substantial market share difference between the top and 2nd rung players. Click on each bar to appreciate the difference between the revenue share:

Let's also get a hang of distribution of companies across above industries.

This will help in filtering out the industries which are overcrowded.

Overcrowding surely means a lot of competition and where there is lot of competition, it's difficult for companies to come out as absolute winners.

Having said that, one must not ignore the role of technology and innovation in overcrowded sector.

If the industry is ripe for disruption, then 2nd rung companies to monopolies, but with innovation DNA can surely be potential multibaggers of the future.

All in all if an industry is overcrowded, do look for players who have key focus on technology adoption and innovation

Anyways, if you are done with clicking around the chart, then let me save you some time on figuring out what kind of opportunity lies in the above industries with respect to finding multibaggers.

Have a look at the table below. It has 2 columns, one Industry and second Multibagger Opportunity. A value of 1000 in second column means, you can find a 1000 bagger opportunity in this industry. Another more logical way of interpreting this is - the top company in this particular industry has a revenue at least 1000 time greater than the 2nd, 3rd, 4th companies. Hence, the second rung companies have the potential to grow 1000 times. Likewise, if the value is 10 in second column then it points to a 10 bagger opportunity which in turn means the top company in this industry has revenue 10 times greater than the 2nd, 3rd, 4th companies. You can click on each row to visualize the revenue share difference. Clicking on the rows will also fill the data in gap below the table - necessary text to preserve the continuity of the article. So please go ahead.

Hopefully, the number of probables have reduced from thousands to hundreds now. So good time to test the probables on other parameters too.

Step 2 - Figuring out if people are taking notice of the stock - Gauging FII, DII, MF interest plus analyzing price, delivery percentage and volume trend

A blatant and bitter truth:

If a particular stock is going to turn to a multibagger, retail investors will be the last one to notice.

Having said that, if you put in a little bit of effort then you can definitely see the early signs.

Heard of the old saying - Multibagger के पांव पालने में ही नजर आ जाते हैं :-).

What I mean to say is, there will be some evident signs which starts getting visible once a mutibagger journey starts.

And those signs are -

a. increase in promoter holdings,

b. increase in holdings of influential DII, FII and Mutual fund houses

Plus this increase in interest will be further validated by increase in volume and security wise delivery percentage.

Needless to say, you will also witness simultaneous increase in price of the stock.

So if you have a filtered list of stocks which you want to test on these parameters, you can use the dropdown below to do the same. Key insights to seek here are -

-

Is the promoter holding increasing with time?

-

Is the DII, FII and MF holding increasing with time?

-

Is the delivery percentage, delivery volume and prices increasing with time?

If all the three check boxes get ticked, then hopefully you have moved one step closer to your target.

So if you notice broader interest from various players then time for additional check.

Step 3 - Figuring out if indices are taking notice of the stock - Studying index inclusion and exclusion history

If a particular company is on right path to become a multibagger, it must also be paid its due by the index creators.

It must progressively enter various thematic indexes ultimately culminating into being included in Nifty 50.

This will be a fantastic journey of a multibegger to a multibagger :-).

You can track index inclusion and exclusion history of stocks below. The dropdown contains the list of stocks which have been moving in and out of the indexes since 1996. Mind you, progressive inclusion is a good sign however inclusion and then exclusion should be treated as red flags.

But we are Humans

We must think differently.

So please allow me to make you think differently -

By the way, thinking differently most often than not means applying common sense.

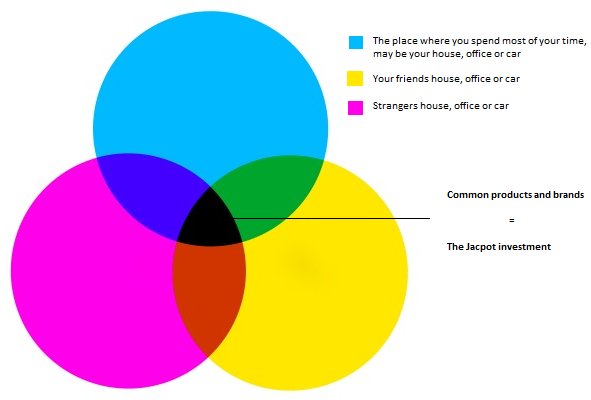

Once you are done with the data analysis and you have the final list of future multibaggers in your hand, you must spend some time on researching what kind of products the company makes.

Very easy to do - just visit their website or do a quick google search. Once you have the product list handy, look at the picture below and see if any of the products qualifies to sit in the black area. If yes, then you have successfully spotted a worthy candidate which deserves a place in your portfolio.

Lets summarize

Your quest to multibagger is a 4 step process:

- Start with a list of 2nd rung companies in a particular industry who are well positioned to challenge the current top player - meaning companies who have been fighting top players monopoly since long while simultaneously bingeing on their revenue and profit share.

- Check if DII's, FII's and Mutual funds are showing interest and the same is being reflected in price, volume and delivery percentage.

- Analyse index inclusion and exclusion history.

- Do a common sense check on how commonly companies products and services are being used.

I will leave you here with your probable list of multibaggers. Happy investing :-). जाते जाते ज्ञान की बात :

A mutibagger has to cross its all time high multiple times. So if you are not courageous enough to buy stocks at all time high, you will surely miss all of them.

And even though this article is about finding multibaggers, in reality they can not be found but only held.

Disclaimer* - The data on this page comes from what we have in our database and is not complete plus there might be inaccuracy in the numbers shown in the tables and charts above. So use this data for analysis purpose only and do not treat it as any recommendation to trade or invest. Also do a second level check for data accuracy from direct sources like NSE and BSE websites.