Lets start with the basics. What is PE Ratio and how it is calculated?

To understand PE ratio, we first need to know what EPS is. EPS stands for Earnings Per Share. It is a financial metric that is used to measure a company's profitability. It is calculated by dividing the company's net income by the number of outstanding shares of stock. Just in case you want to check the net income, EPS and other P&L details for different companies, you can do a detailed analysis here.

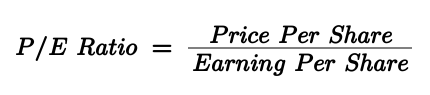

Now getting back to The Price-to-Earnings (P/E) ratio. PE is a well known financial ratio that is used to evaluate a stock's value and its potential for growth. P/E ratio is calculated by dividing the current market price of a stock by its EPS (earnings per share).

An Example:

Stock ABC price: ₹ 10.00

Annual EPS: ₹ 1.00

P/E = 10.00 / 1.00

P/E = 10

Here is an interesting way to look at PE ratio.

Intuitively, PE is the number of years it will take to get back your investment through earnings of the particular company provided its future performance (earnings) remains exactly same as of now.

So for above example, if the company ABC's future performance remains the same as it is now (i.e. ₹ 1 EPS every year), it would take 10 years for an investor to recoup their investment (the price they paid for the share - ₹ 10) through the earnings of the company. And that's what the PE of the stock is i.e. 10 currently.

How to interpret P/E ratio: what high or low P/E ratio actually mean?

Simply put, PE ratio answers the following question:

Is this stock cheap or expensive?

PE basically helps investors to understand how much they are paying for each dollar of a company's earnings.

A high P/E ratio means that investors are paying a relatively high price for each dollar of earnings.

There are two ways to interpret it.

One, this may indicates that investors have high expectations for the company's future growth potential. Two, the company is overvalued, and its stock price may be due for a correction.

Now the Million Dollar question is: which of the two interpretations of high PE is correct? We will figure out in the next section.

Similarly, a low P/E ratio means that investors are paying a relatively low price for each dollar of earnings, which indicates that they have lower expectations for the company's future growth potential. A company with a low P/E ratio may be undervalued and its stock price may be due for an up move.

But that's not all. There is another angle.

P/E ratio alone might not be meaningful as different sectors and industries have different average P/E ratios. For example, technology companies tend to have higher P/E ratios than utilities companies, so a high P/E ratio might be normal for a technology company, however not for a utilities company. Therefore, it's important to compare the P/E ratio of a stock to that of its industry peers to get a better understanding of its relative value.

How P/E ratio is used to evaluate a stock's value and potential for growth

PE ratio on its own does not offer any insight about the stocks value. But when used as a relative measure, it does offer powerful insights.

When using P/E ratio to evaluate a stock's value, investors must look at how the P/E ratio compares to the industry average. All else equal, a stock with a P/E ratio that is higher than the industry average may be considered overvalued, while a stock with a P/E ratio that is lower than the industry average may be considered undervalued.

When using P/E ratio to evaluate a stock's potential for growth, investors must look at the company's historical P/E ratio and compare it to the current P/E ratio. If the current P/E ratio is lower than the historical average, it may indicate that the stock is undervalued and has potential for growth. If the current P/E ratio is higher than the historical average, it may indicate that the stock is overvalued and has less potential for growth.

Here are some examples of how to use P/E ratio to evaluate a stock

Compare a stock's P/E ratio to the industry average: By comparing a stock's P/E ratio to the industry average, you can get a sense of whether the stock is overvalued or undervalued. For example, if the industry average P/E ratio is 15, and a stock has a P/E ratio of 20, it may be considered overvalued. On the other hand, if a stock has a P/E ratio of 10, it may be considered undervalued.

Compare a stock's historical P/E ratio to its current P/E ratio: By comparing a stock's historical P/E ratio to its current P/E ratio, you can get a sense of whether the stock is overvalued or undervalued. If the current P/E ratio is higher than the historical average, it may indicate that the stock is overvalued, while a current P/E ratio that is lower than the historical average may indicate that the stock is undervalued.

Compare a stock's P/E ratio to its growth rate of earnings: By comparing a stock's P/E ratio to its growth rate, you can get a sense of whether the stock's price is justified by its growth prospects. A stock with a high P/E ratio and a high growth rate may be considered fairly valued, while a stock with a high P/E ratio and a low growth rate of earnings or EPS may be considered overvalued. On the other hand, a stock with a low P/E ratio and a high growth rate may be considered undervalued, while a stock with a low P/E ratio and a low growth rate may be considered fairly valued.

Compare a stock's P/E ratio to the P/E ratios of its competitors: By comparing a stock's P/E ratio to the P/E ratios of its competitors, you can get a sense of how the stock is valued relative to its peers. A stock with a P/E ratio that is higher than its competitors may be considered overvalued, while a stock with a P/E ratio that is lower than its competitors may be considered undervalued.

Use P/E ratio in conjunction with other financial metrics: P/E ratio is just one tool that investors use to evaluate a stock's value and potential for growth. It's important to use P/E ratio in conjunction with other financial metrics, such as EPS, revenue growth, and debt-to-equity ratio, to get a more complete picture of a company's financial health. By using P/E ratio together with other financial metrics, investors can make more informed investment decisions.

Generally speaking, the P/E ratio is a better indicator of the value of a share than the share price alone as it enables you to:

-

-

- Determine the attractiveness of a stocks price relative to overall market (Stock PE ratio vs the Index PE)

- Determine the attractiveness of a stocks price relative to its peer companies (Stock PE ratio vs Sectoral Index PE)

-

What is the difference between Trailing P/E, Forward P/E, Cyclically Adjusted P/E, and PEG ratio and how they can be used to evaluate a stock?

Trailing P/E ratio is a valuation ratio that compares a company's current stock price to its per-share earnings over the past 12 months. It is calculated by dividing the current stock price by the earnings per share (EPS) over the past 12 months.

Forward P/E ratio is a valuation ratio that compares a company's current stock price to its estimated earnings per share (EPS) over the next 12 months. It is calculated by dividing the current stock price by the estimated EPS for the next 12 months.

Cyclically Adjusted P/E (CAPE) ratio is a valuation ratio that compares a company's current stock price to its average earnings per share (EPS) over a 10-year period, adjusted for inflation. It is calculated by dividing the current stock price by the average inflation-adjusted EPS over the past 10 years.

PEG ratio (price-to-earnings-to-growth) is a valuation ratio that compares a company's P/E ratio to its earnings growth rate. It is calculated by dividing the P/E ratio by the company's earnings growth rate.

All these different versions of PE ratios are used to evaluate a stock by comparing the stock's price to its earnings or growth. The preference is completely based on how aggressive or conservative you want to be in your valuation estimates. Having said that, all else equal, a lower ratio indicates that a stock is undervalued compared to its peers, while a higher ratio indicates that a stock is overvalued compared to its peers.

When it comes to a broader investment strategy, P/E ratio can be used as a tool for rebalancing, diversification and risk management.

Rebalancing is the process of readjusting the weightings of different assets in a portfolio to align them with the investor's desired asset allocation. By regularly monitoring the P/E ratio of the stocks in a portfolio, an investor can identify any stocks that have become overvalued or undervalued relative to their historical average or to the average of their industry or sector.

For example, if a stock in a portfolio has a high P/E ratio, indicating that it may be overvalued, the investor may choose to sell some of that stock and use the proceeds to purchase other stocks that have a lower P/E ratio and may be undervalued. This can help to manage risk and maintain the desired level of diversification in the portfolio.

Diversification is the practice of spreading investments across different types of assets, such as stocks, bonds, and real estate, in order to reduce the overall risk of the portfolio. By including stocks with different P/E ratios in a portfolio, an investor can reduce the risk of the portfolio by investing in stocks with different growth prospects and valuations.

Risk management is the practice of identifying and mitigating potential risks in an investment portfolio. P/E ratio can be used as a tool for risk management by identifying stocks that are overvalued or undervalued. Overvalued stocks have a high P/E ratio, which indicates that investors have high expectations for the company's future growth potential. These stocks may be at a higher risk of a price correction. Undervalued stocks have a low P/E ratio, which indicates that investors have lower expectations for the company's future growth potential. These stocks may be at a lower risk of a price correction.

How the P/E ratio can be affected by the broader economic environment, such as interest rates, inflation, and economic growth?

The P/E ratio, or price-to-earnings ratio, is a valuation metric used to compare a company's current share price to its per-share earnings. The P/E ratio can be affected by the broader economic environment in several ways:

Interest rates: When interest rates are high, it can make it more expensive for companies to borrow money, which can lower their profits and in turn lower their P/E ratio. Conversely, when interest rates are low, it can make it cheaper for companies to borrow money, which can increase their profits and raise their P/E ratio.

Inflation: High inflation can increase a company's costs, such as the cost of goods and labor, which can lower their profits and lower their P/E ratio. Low inflation can decrease a company's costs, which can increase their profits and raise their P/E ratio.

Economic growth: In a growing economy, companies may see increased demand for their products and services, which can lead to increased profits and a higher P/E ratio. In a stagnant or declining economy, companies may see decreased demand for their products and services, which can lead to decreased profits and a lower P/E ratio.

Here is a commonly observed phenomena that can be exploited as smart investors:

Bull markets lead to high PEs across the board just because of greed and Bear Markets lead to depressed PEs across the board just because of excessive fear.

You can use Nifty PE ratio to clearly identify if we are near the top of roaring bull market or near the reversal point of a depressing bear market. Once ascertained the tipping point, you can exploit the anomaly for super normal returns, that too within a shorter time frame.

I think this much is enough to digest on this topic. Will leave you here with an interesting question.

Q: What happens to stocks whose EPS and PE keeps growing with time?

A: They become multibaggers. Want to search them? You can do it here.

Hopefully now you know which kind of companies you have to hold in your portfolio. Happy Investing !!!