In the previous tutorial of our stock market 101 series, 'Journey of a Stock Market Beginner', I talked about the importance of setting up realistic return expectations when investing in the stock market. If you haven't had the chance to read it yet, I highly recommend that you do so. It will provide the context for the concept I am going to discuss in this part. However, if you are in a hurry, this is what I said about setting up realistic return expectation in that part:

The first target should be to beat savings deposit rate (5%). The second is to beat inflation (8%), the third is to beat the nifty return (12%). And then think of beating Warren Buffett (20%).

So that we are on same page - when I say Return, it simply means the profit or gain you earn on your investment over a certain period of time.

Now for another 5 min or so, we will dive deeper to understand the nuances of setting up right return expectations for your stock investments. Believe me, it is way more important than you think.

Let's start by imagining Stock Market being analogous to a video game. This is how you can quantify your competency in the game. We will revisit this table at the end of the article.

| While investing you |

Competency wise |

| Lost a lot of money |

You are on level 0 |

| Lost small amount of money |

You are on level 1 |

| Preserved your लंगोट. Sorry I meant capital. |

You are on level 2 |

| Beat saving rates return (5% CAGR) |

You are on level 3 |

| Beat Nifty returns (12% CAGR) |

You are on level 4 |

| Earning 21% CAGR in multi year time frame |

You are on प्रभु आपके चरण कहाँ हैं level |

In case you are wondering what CAGR is, here is its literal meaning.

Compound Annual Growth Rate (CAGR) is a metric used to measure the average rate of return of an investment over a specified period of time, assuming reinvestment of returns.

And here is its figurative meaning.

CAGR is basically your identity in Stock Market. It is a direct measure of your capability and authenticity.

Let me tell you a secret. Assume you really want to get rid of an tipster or a adviser or a trainer or anyone who you no longer feel trustworthy. Just ask the following question after their sales pitch:

तुम्हारा CAGR क्या है बसंती ?

And hopefully, you will never see them crossing your path ever again.

Trust me it works. Whenever I ask this question, I get to hear their कराह and not their CAGR ;-).

When in stock market, it's not what's your name, but what's your CAGR.

Anyways, just to give you an idea, here is how I perceive return on investment. Any number between 12% to 16% over a longer period of time is way too good for me. That's my realistic expectation from market, you know.

This article is all about why I think so. And of course also about convincing you to think so. Why? Because, realistic expectation will surely save you from committing most of the greed driven mistakes.

Greed, as they say is never good in stock market.

But, do you know what is even worse. Convincing others about your belief. Everyone has their own :-).

So in the tough pursuit to convince you about my belief, I will start by telling you how to quantify 5%, 12% or 21% CAGR in terms of time frame. And for that, please allow me to introduce you to The Rule of 72.

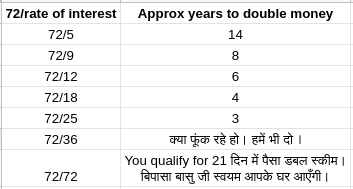

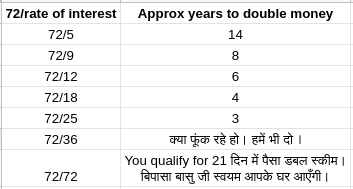

The Rule of 72

Rule of 72 is a useful tool that helps you estimate the time it takes for your investment to double in value given a fixed annual rate of return (CAGR). Here's how it works:

- Divide 72 by the annual rate of return you expect to receive on your investment.

- The result is the number of years it will take for your investment to double in value.

For example, if you expect a return of 8% per year, it will take approximately 9 years (72 divided by 8) for your investment to double in value.

The Rule of 72 is a simple, rough estimate and may not be entirely accurate, but it provides a useful starting point for understanding the relationship between the rate of return and the time it takes for an investment to double itself.

Assuming you are a beginner, here is a sneak peek into how veterans perceive Rule of 72.

Sorry, but I was totally confused about why they have not put number of years in the last 2 rows. I am sure you are confused too. But, don't worry. You will figure it out by the end of this article as I did eventually.

Anyways, let's apply Rule of 72 to quantify your level of patience. Why I am trying to quantify your level of patience? You will get to know in a bit.

You are way more patient than you think. Here is how.

Having understood Rule of 72, let's review one real life examples where almost all of us earn returns from our investment. Yes I am talking about your banks savings and fixed deposits.

Let's figure out how the return translates to time frame for our savings account.

When you put your money in bank fixed deposit untouched, it will double itself in approximately 12 years taking best case scenario of 6% interest rate. When was the last time you looked at your savings from this angle?

If you don't remember, then let me assure you, you are perfectly normal.

Here is what I want to convey.

There is a bank which offers to double your money in 12 years and you willingly lend your money to grab the offer (6% return). Commendable display of patience by you, if I must say.

I am totally confused where from this meme appeared in such a serious discussion. Please ignore. Seems my editor has gone nuts 😬.

Let's invert now. Change of roles. You are now a borrower and not lender.

When you go to the bank, they willingly offer you personal loan @ 16%. Car loan @ 10 % and home loan @ 9%. Banks which are naturally stronger than you and can endure more financial pain entrusts you with their money in exchange of 16 % return.

The same bank lends money to listed companies too. And their average lending rate ranges from 5% to 15% depending on several factors such as the industry, the financial health of the company, the level of risk associated with the company's operations, and the overall economic environment.

So it would not be wrong to assume that 16% is a kind of upper cap on return expectations on the money Banks lend to either an individual or a company.

Let's go to the stock market now. Simply put, this is what I am doing when I buy a stock.

I am lending my money to a promoter who I think is credible and will provide me a return of .....?....% on the capital I invested (a.k.a. the share price I paid).

What do you think? Based on the previous discussion, will it be wise of me to put ? = 16% considering Promoter is a human being like you and me whom the Bank we discussed earlier will also hopefully lend @ of 5% to 15%?

It's pure common sense. I am just thinking like a Bank. I can put in any number over there which could be way greater than 16%. But then we will miss the whole point of being realistic. No?

Hope now you understand where the 16% is coming from in the 12% to 16% range I mentioned above.

But this was not the end. I did not stop here. I thought I could do better than this. Come on man. I am not in stock market to merely earn 16% when everyone around me (by everyone i mean tv analysts, my brokers employee, advisors, trainers etc etc.) is doubling money every year. Believe me, there are some who are capable enough to double it every month.

Once this thought crossed my mind, I literally thanked god for the sanity he provided for believing in myself at the exact right moment. With the extra dose of motivation, I did some more digging in order to extend the 16% upper cap. Want to know what I did? Here you go:

Step 1

First I created a simple mapping of what I want and for that, how much return I will need. A more accurate version of The Rule of 72 you may say:

| If I want to |

I will need a return of |

| Double my money every year |

100% |

| Double my money every 2 year |

41% |

| Double my money every 3 year |

26% |

| Double my money every 4 year |

19% |

| Double my money every 5 year |

15% |

| Double my money every 6 year |

12% |

Step 2

Then I tried to dig out some names who have been there done that over a longer period of time:

| Who has doubled money in |

Do I know him personally |

Do any of my family members know them |

How many authentic names appeared on google search |

| 1 Year |

No |

No |

0 |

| 2 Year |

No |

No |

1 |

| 3 Year |

No |

No |

5 - 10 |

| 4 Year |

No |

No |

Below 100 |

It hit me suddenly that there are 8 billion people in world currently. I myself live in a country having approximately 1.5 billion people.

Then I compared these numbers with the Google Search Count column above. Don't know why, but I started feeling suicidal ;-). And I finally believed what I never believed earlier. That next to impossible is a real English word.

Just in case you did not notice, there was something even more depressing than suicidal tendency. The above exercise did not reveal much about me, however it did reveal a lot about my family members. No disrespect but Oh Dear God why did you choose to gift me to such a Bunch of Losers 😭.

Anyways, after this earth shattering emotional experience, one thing was crystal clear to me:

The counting of return ends at 20%.

From that day onward, whosoever talks about any number greater than 20, I straight away tag him as 420.

By the way, do you know what kind of expectation I started with when I entered the stock market. You won't believe it.

It was just 5%.

5% per month to be exact.

Did I achieve it.

Hell Yaaaaaa, I achieved 5 %.

If you are feeling depressed, let me cheer you up as nothing cheers up a human more than the failure of a fellow human.

I achieved 5% per year not per month. There is an English word for the joy you are feeling at this moment - Sadistic Pleasure.

Anyways, my quest to find the upper cap of realistic expectation ended here. I settled for 16% and not 20%. Here is why:

No amount of caution or realism is going to save me from making some costly stupid decisions in future. So the 4% hair cut is what I call as My Margin Of Stupidity.

Right time to find out the source of lower cap i.e. 12%?

After figuring out what kind of return over long term will make me immensely happy (16%), the next logical question to ask was:

What if I fail to earn 16%. What is the lowest return over longer period of time that will still keep me happy if not immensely happy?

After little bit of thinking, I re-framed the above question as:

What is the lowest return I can earn from stock market over a longer period of time without doing much? If I manage to earn above this minimum, logically speaking, I should still be happy.

The answer to above question was something round 12%.

How did I reach this figure? I simply looked at Nifty CAGR over a longer period of time. If you want to have a look yourself,

you can do it here.

If you are wondering, 12% return without doing anything - how? Here is how.

What you have to do is just to buy a Nifty ETF and hold it for very long time. It's as simple as this. However not easy as holding period could be of 10 to 20 years.

But hold on. You have already shown commendable patience in the past. No? Remember, we discussed your FD returns above - the 12 year it takes to double your money. So why not this option. Your return will be double that of FD. And you have to do nothing additional.

Old Strategy: You put money in FD. Sit and wait. Reap 6%.

New Strategy: Buy Nifty ETF instead of investing in FD. Sit and wait. Reap 12%.

Serendipitous to say the least.

So after this QnA session, I had my realistic expectation range which turned out to be 12% to 20%.

Having discussed my framework on setting up realistic expectation, I will leave you here and let you decide yours. But not before showing this table again.

| While investing you |

Competency wise |

| Lost a lot of money |

You are on level 0 |

| Lost small amount of money |

You are on level 1 |

| Preserved your लंगोट. Sorry I meant capital. |

You are on level 2 |

| Beat saving rates return (5% CAGR) |

You are on level 3 |

| Beat Nifty returns (12% CAGR) |

You are on level 4 |

| Earning 21% CAGR in multi year time frame |

You are on प्रभु आपके चरण कहाँ हैं level |

Although, you are free to choose any range, crosschecking what level you are currently on in stock market game will do the much needed reality check automatically.

And it will also help in answering the question I asked about Veterans Rule Of 72 table. Remember they did not put number of years in the last 2 rows. Now you know why ;-).

By for now and Happy Investing !